Cookie Preferences

By clicking, you agree to store cookies on your device to enhance navigation, analyze usage, and support marketing.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

October 1, 2025 - Sponsored by Great Pacific Gold Corp

Gold is experiencing a tailwind with an all-time high nominal price of USD $3,895.09, achieved on October 1, 2025...

Uncertainty on the markets, high government deficits and the energy hunger of modern technologies support the price.

In this environment, investors are looking for gold mining explorers with clear catalysts – i.e. tangible news that could quickly brings movement to the price.

Great Pacific Gold trading under $GPAC on the TSX.V is our featured stock of the month.

This 3-in-1 gold story combines exposure now belongs on everyone's shortlist for gold stocks. Read this article to find out why.

Great Pacific Gold (TSXV: GPAC | OTC: GPGCF | FSE: V3H) combines three interesting points for investors:

The result: an explorer that combines news flow, scaling opportunities and financing security – a profile that is particularly in demand in the current market phase.

On September 2, 2025, Great Pacific Gold (TSXV:GPAC) announced one of the most impressive drill results seen in Papua New Guinea in recent years: Hole WDG-08 intersected 8.4 metres grading 49.9 g/t gold equivalent (including 3.8 m at 105 g/t AuEq and a bonanza zone of 0.8 m at over 320 g/t AuEq).

These intercepts highlight the exceptionally high-grade nature of the Wild Dog epithermal system. In addition to gold, the core returned significant copper (up to 6.6%) and silver grades (up to 142 g/t) – clear evidence of a robust polymetallic vein corridor. According to VP Exploration Callum Spink, this hole drilled “directly into the heart of the system.”

For investors, this means: Wild Dog is not only large in scale, but also delivers bonanza-grade hits – a double lever for rapid re-rating.

Geopolitical tensions, high deficits and the energy hunger of AI data centres are structurally keeping the gold price high. Capital flows into explorers with clear catalysts – this is exactly where TSXV:GPAC fits perfectly into the picture.

CEO Greg McCunn puts it in a nutshell in an interview: "functioning regulators... very strong safety culture... elephant country".

.jpeg)

For investors, this means that GPAC:TSXV combines news flow, scaling and financing security – a setup that translates into valuations at an above-average rate in a friendly gold market.

Papua New Guinea (PNG) is known in the mining world as " elephant country" – a term for regions where particularly large gold and copper systems occurs. PNG is one of the most interesting addresses for investors because high-grade gold veins (epithermal systems) and large-scale copper-gold deposits (porphyries) overlap here.

Crucially, Papua New Guinea (PNG) is predictable. CEO Greg McCunn describes the market as a jurisdiction with "functioning regulators" – i.e. functioning supervisory authorities and clear mining laws. The fact that international producers have been operating successfully there for decades is confirmed by the Ownership security and approvability.

Notable examples include:

The workforce is also an advantage: Papua New Guinea (PNG) has experienced crews who work according to international standards. McCunn emphasizes the "very strong safety culture" – fewer failures, stable processes and reliable safety processes.

In addition, there is logistics: Wild Dog is located near the ports of Rabaul and Kokopo, which means that material and samples can be transported quickly. Using modern technology such as LiDAR (laser scan of topography) and MobileMT (electromagnetic depth measurement), GPAC:TSXV can plan holes with centimetre accuracy and align them with the most promising targets. This saves time, reduces costs and increases the chance of hits.

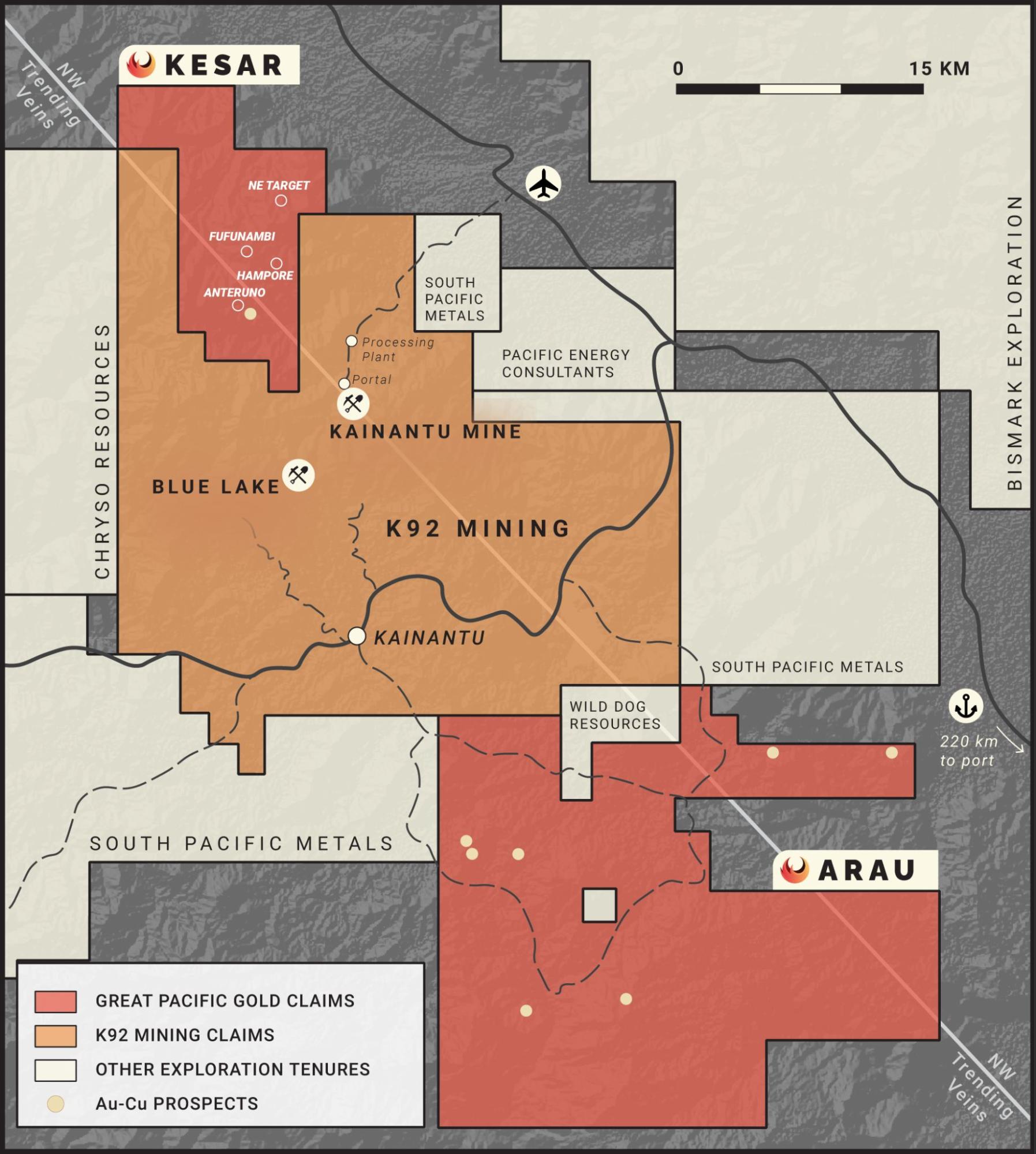

An additional plus is the Kainantu Pipeline: With the Kesar and Arau projects, GPAC:TSXV is directly adjacent to K92 Mining, a successful producer in the region. This reduces the risk and creates a second news flow next to Wild Dog. Further strengthening this link, GPAC:TSXV has two K92 executives on its team - one serving as an Advisor and the other as a Board member - bringing direct operational expertise from one of PNG’s most successful gold producers.

In short, Papua New Guinea (PNG) offers stable regulation, an experienced workforce, world-class geology, and logistical advantages – a rare combination that translates projects into assessments faster.

The Wild Dog Project is the heart of GPAC:TSXV. It is located in the Province of East New Britain and covers a large-scale, high-grade gold system. Studies with MobileMT show a 15 km long epithermal corridor, which reaches a depth of over 1,000 meters. In addition, Porphyry Targets – large copper-gold systems that are interesting for possible later large-scale production.

The drilling program is already in full swing. Originally planned for 2,500 metres, the programme was doubled to 5,000 metres in August 2025 – a strong signal of confidence in the geological model. At the same time, a LiDAR flight will be carried out, which will map the terrain topography with high precision and ensure even better placement of the boreholes.

Initial results are encouraging: 6.0 m of 8.6 g/t AuEq (including 2.4 m of 20.2 g/t AuEq) and 3.5 m of 13.1 g/t AuEq. These values are near-surface and could open up a scenario for open pit mining if continuity is confirmed.Most recently, Hole WDG-08 intercepted 8.4 m at 49.9 g/t AuEq from 154 m (including 3.8 m at 105 g/t AuEq), marking one of the strongest hits to date and underscoring the high-grade potential at Wild Dog.

Logistically, Wild Dog is well positioned: an access road has been completed, the proximity to the ports reduces transport times, and the environmental basics have already been tested before the start. CEO McCunn is convinced: "I stood there and thought – a mine is going to be built here."

Why it counts: Wild Dog offers the rare combination of short-term high-grade news and long-term scaling. For investors, this is a classic lever for discovery dynamics.

One of the biggest sticking points with junior explorers is financing. Often, companies must constantly issue new shares, which dilutes existing investors. GPAC:TSXV takes a different approach and relies on non-dilutive financing – i.e. capital inflows without new shares.

In August 2025, the Company reported C$1.83 million from asset sales that go directly into the drill program. In addition, the Walhalla spin-out will raise additional C$1.5 million and secure a 2% royalty (NSR) on the project for GPAC:TSXV. Shareholders will also receive 1:1 dividend share from Walhalla – a free participation in an additional value driver. In July, the company closed a C$16.9 million financing, providing robust funding to accelerate exploration and de-risk the upcoming drill campaign.

GPAC:TSXV maintains strong liquidity without continuous dilution, using strategic investments in partner projects as a reserve. According to the company’s corporate presentation, GPAC currently holds $18 million in cash, supporting ongoing exploration and upcoming drill programs.

GPAC:TSXV maximizes drilling meters per share without diluting the price with new shares. This is a clear competitive advantage in the junior segment.

In a recent interview with the KE Report, CEO Greg McCunn highlights why Great Pacific Gold is well-positioned for discovery and growth in Papua New Guinea.

GPAC:TSXV combines best-in-class teams, strategic assets, and a strong balance sheet - setting the stage for meaningful exploration success in a proven jurisdiction.

McCunn also emphasizes:

The interview shows that GPAC:TSXV operates several levers at once - discovery news, pipeline projects and a free spin-out. This increases the likelihood that the company will end up in shortlists for gold stocks.

In exploration, strong management is a key factor for success. Greg McCunn brings a rare combination: production experience + financial discipline.

At GPAC:TSXV, he puts this experience directly into practice: capital architecture without permanent equity, clearly prioritized funds, spin-out structure and targeted drilling. For investors, this means a higher probability that strong drilling results will quickly lead to a reliable project evaluation.

A CEO with production experience reduces the implementation risk - an important "soft factor" that makes the difference for explorers.

Many juniors fail not because of geology, but because of permits, community issues, or inefficient programs. GPAC:TSXV addresses exactly these points:

ESG upfront + precise targeting + proximity to the port translate into lower risk, faster results and predictable value creation.

Wild Dog combines two value drivers in an area close to port infrastructure:

Precise target definition via LiDAR (laser scan for exact terrain models) and MobileMT (depth EM) as well as access road & environmental basic data are done. According to the CEO, PNG offers reliable authorities and a strong security culture.

Result: Data rooms become "green" faster, farm-ins/JVs become more likely.

Kesar is located right next to K92 Mining (Kainantu Belt) – a plus for infrastructure and model. Arau adds additional target types (high-sulphide epithermal/porphyry). For strategists, this means options: partial JV here, earn-in there – without diluting the core story.

The Walhalla spin-out (1:1) gives shareholders extra leverage, while 2% NSR remains with GPAC:TSXV and C$1.5M cash flows. The PNG assets remain focused in the parent company – exactly the clarity that buyers like.

GPAC:TSXV ticks a lot of boxes that prioritize JV/M&A team. With every metre of drilling, the strategic probability increases - with a secured running time through non-dilutive cash + spin-out funds.

The Wild Dog program has been increased to 5,000 m; targets have been sharpened by LiDAR. MobileMT shows the ~15 km trend plus porphyry targets; first near-surface highs are available. Historically, the largest percentage reassessment occurs before a series of consistent hits.

Additional non-dilutive funds and the Walhalla spin-out (cash inflow + 2% NSR) mean: more meters, less dilution. This increases the leverage effect of good results.

PNG scores with predictable permits, safety culture and "elephant country" geology – this accelerates the translation of drilling meters into evaluation.

"Getting on board now means taking Wild Dog News, Kesar and Arau optionality and Walhalla spin-out with you – financed, data-driven and with a locational advantage."

For investors in exploration stocks, looking ahead is crucial: What news is coming next? What drill results, studies or transaction steps can move the price?

At Great Pacific Gold (GPAC:TSXV), the pipeline is unusually tight. The company is delivering on three levels: ongoing drill results from the flagship Wild Dog, a growing pipeline in Kainantu (Kesar & Arau) and an additional spin-out with Walhalla in Australia.

This results in a roadmap that sets both short-term and medium-term triggers – and gives investors the chance to be positioned before a series of potentially price-relevant reports.

The sequence combines discovery torque (Wild Dog) with pipeline news (Kesar/Arau) and a spin-out lever (Walhalla) - a mix that often reaches valuations disproportionately quickly in selective phases

Every explorer comes with risks. From geological uncertainties to weather and permits to funding and timelines. Anyone who invests in gold stocks knows that not every well automatically leads to the resource – and that delays, or dilution can weigh on the price. The decisive factor is therefore how a company addresses these risks.

Great Pacific Gold (GPAC:TSXV) is taking an unusually clear path right here: with modern technologies such as MobileMT and LiDAR, with solid financing without permanent equity and with a clean logistics and approval basis. For investors, this means that the usual stumbling blocks are defused in a targeted manner, which increases the likelihood that drilling meters will be translated into assessable results more quickly.

What does that mean? Not every geophysical anomaly becomes a resource. Epithermal veins can wedge out laterally.

GPAC's answer: MobileMT maps ~15 km trend with >1,000 m depth, LiDAR provides centimetre-accurate topography for precise drill points. The focus is on consistent series instead of single-hole stories.

Investor Benefit: Increases the likelihood that meters of drilling will result in assessable results.

What does that mean? Jungle/relief and rainy season can shift frequency and costs.

GPAC's answer: Near the port of Rabaul/Kokopo, completed access road and environmental baseline. Experienced crews + a strong safety culture stabilize the process.

Investor benefit: Fewer lost days → predictable news flow.

What does that mean? Government/community issues may be delayed.

GPAC's answer: Proactive baseline and modular work programs (near-surface → step-outs).

Investor benefit: Reduces surprises and strengthens local acceptance.

What does that mean? Juniors risk capital increases at the wrong time.

GPAC's response: C$1.83 million non-dilutive + Walhalla spin-out (C$1.5 million cash, 2% NSR on TSXV). Additional asset holdings instead of new issues.

Investor benefit: More meters without permanent dilution → better leverage for good results.

What does that mean? Assay turnarounds and rainy season can delay news.

GPAC's answer: Program upsize to 5,000 m + parallel pipeline (Kesar/Arau). LiDAR accelerates phase-2.

Investor benefit: More stable news cycle, less idleness.

What does that mean? High grades alone do not guarantee cost-effectiveness.

GPAC's answer: Combination of epithermal (near-surface) + porphyry (bulk option). Step-outs, vector chemistry and porphyry scouting are underway.

Investor Benefit: More options for resource & later studies.

What does that mean? Rules are subject to change.

GPAC's answer: PNG with large operators as a reality check; Diversification through spin-out (Australia).

Investor benefit: Risk diversification across two jurisdictions.

Bottom Line: GPAC:TSXV counters the core risks of an explorer with data precision, logistics advantage, de-risky financing, and a multi-pronged pipeline – a setup that shifts the opportunity/risk asymmetry in favour of investors.

The most important points from strategy, projects and financing can be summarised in twelve facts. They show why Great Pacific Gold (TSX:GPAC) is more than just a single project. An explorer with three value drivers – discovery, pipeline and spin-out – that offers investors multiple opportunities in one lot.

Great Pacific Gold (TSX:GPAC) is more than a classic explorer. The company combines three levers that are particularly important in this market phase: discovery potential at Wild Dog, pipeline optionality through Kesar & Arau, and additional equity values via the Walhalla spin-out. In addition, there is a management with production experience, a jurisdiction with plannable framework conditions and financing that does not require constant dilution.

For investors, this means that those who position themselves now ahead of the upcoming assays, phase 2 planning and Walhalla allocation will secure a setup that combines news flow, scale and shareholder value. In an environment where gold has a tailwind as a safe haven, TSX:GPAC is an explorer that should not be missing from shortlists for gold stocks.

Sources

1Great Pacific Gold – Wild Dog project page

2Great Pacific Gold expands Wild Dog drill program to 5,000 m & initiates LiDAR (Aug 25, 2025) – Junior Mining Network (Reproduction Newsfile)

3Geophysics confirms ~15 km high-grade epithermal trend & porphyry potential (Aug 18, 2025) – Junior Mining Network (Reproduction Newsfile)

4Geophysics confirms large-scale high-grade epithermal system & porphyry gold-copper potential – StockTitan (Reproduction Newsfile)

5Great Pacific Gold announces additional C$1.83M non-dilutive cash for 2025 programs (Aug 11, 2025)

6Great Pacific Gold begins Phase I drilling at Wild Dog; MobileMT outlines ~15 km trend (May 19, 2025) – Newsfile

7Great Pacific Gold begins first phase of drilling at Wild Dog (May 07, 2025) – Junior Mining Network

8Two drill rigs target high-grade epithermal gold at Wild Dog; 8.4 m @ 50.3 g/t AuEq (Aug 25, 2025) – Lex Corporation | https://x.com/gpacgold/status/1962844220365914257

9Wild Dog – Geophysical survey commences (MobileMT) (Mar 13, 2025) – Yahoo Finance (Reproduction Newsfile)

10Great Pacific Gold identifies multiple high-grade gold veins in outcrop at Wild Dog (Jun 16, 2025) – Yahoo Finance (Reproduction)

11Great Pacific Gold – Newsfeed including Aug news (LiDAR/5,000 m; Geophysics/Porphyry) – Newsfile Company Page

12Great Pacific Gold Kesar Project Update (Anteruno/Hampore/Fufunambi) – Yahoo Finance

13Kesar update: adjacent to K92 Mining, ~6 km from K92 portal – Junior Mining Network

14Great Pacific Gold sells Lauriston to focus on PNG; Arau/Mt. Victor status incl. Elandora – Newsfile (May 6, 2025)

15Great Pacific Gold announces agreement to spin out Walhalla (1:1 shares; 2% NSR) – Nasdaq

16Article: "Great Pacific Gold Provides Wild Dog Project in PNG" – Junior-Mining.com (background/analysis on Wild Dog)

17YouTube Interview: Departures Capital × GPAC – CEO Greg McCunn

18https://www.newsfilecorp.com/release/264511

Legal Notice / Disclaimer

Advertisement/Advertorial

This article is for advertising and informational purposes only. It does not constitute investment advice or a buy/sell recommendation and does not constitute an offer to purchase securities. Decisions on investments in securities should only be made after your own research, examination of the issuer's original documents and, if necessary, obtaining independent, expert advice.

Exploration Risk Disclosure

Early-stage exploration companies are highly speculative. There are significant risks including geology/exploration success, permitting/ESG, financing, timing, commodity prices, currency and country risks. A total loss of the capital invested is possible.

Forward-Looking Statements

Portions of this paper contain forward-looking statements (e.g., on planned drill meters, programs, schedules, spin-out steps, potential resources, financing, JV/M&A options). These statements are based on assumptions and are subject to known and unknown risks and uncertainties; actual results may differ materially. There is no obligation to update such statements, except as required by law.

Sources & Accuracy

Data, metrics, quotes, and timestamps are derived from company disclosures and publicly available press releases/IR documents/presentations, as well as the interview; they have been merged with care, but may contain errors or be overtaken by current news. The latest original documents of the company are always decisive. Historical third-party production data (e.g., GeoVic) are historical references and are not guarantees of future results.

Conflicts of Interest / Sponsored Content

The linked video interview has been marked as sponsored content. Remuneration/cooperation can give rise to interests. Readers should assume possible conflicts of interest and critically examine information.No price/earnings commitments. References to previous management activities (e.g. production volumes, financing, transactions) serve exclusively to classify the vita. No conclusions should be drawn from this about future price, earnings or valuation developments of GPAC.

Legal Notices

The distribution of this article may be subject to legal restrictions. Recipients are responsible for complying with local regulations. Taxes, fees (e.g. in the case of spin-outs/dividends in tangible assets) and reporting obligations are the responsibility of the investor.

Disclaimer

All information without guarantee. No liability is assumed for material or immaterial damage resulting from the use of the information.

IMPORTANT NOTICE AND DISCLAIMER

Copyright 2025 © investorstockpick.com is owned and operated by Connect 4 Marketing Ltd., a Quebec corporation. Contact: info@connect4marketing.io. This is the official website of investorstockpick.com and is not affiliated with Questrade, Interactive Broker, TD Ameritrade, Fidelity, Charles Schwab, or Orbiton Financial.

Compensation Disclosure

Great Pacific Gold Corp. has paid Connect 4 Marketing Ltd. (“Publisher”) a total of USD $38,114.50 (including GST) for marketing services, including communicating information about the company to the public. This advertorial (“Advertorial”) is part of that agreement. The contract was effective August 14, 2025 and continues until the budget is exhausted unless terminated or extended in writing. Publisher may also collect reader email addresses, which it may monetize.

As of the date of this Advertorial, Publisher holds no securities of Great Pacific Gold Corp. and does not intend to purchase any during the contract term. Marketing services may result in greater investor awareness, trading activity, and/or a temporary increase in share price.

Educational and Informational Purposes Only

This Advertorial is not investment advice. Information is believed reliable but not guaranteed for accuracy or completeness. It does not constitute a full analysis of any company’s financial condition, nor is it tailored to individual investment needs. Do not rely on this material to buy, sell, or hold securities. Always consult a licensed or registered professional before making investment decisions.

Substantial Risk

Investing in securities involves significant risk, including the possible loss of your entire investment. Readers are solely responsible for their own investment research and decisions. Use this Advertorial only as a starting point for further independent research.

Not an Investment Advisor

Publisher and its owners, employees, and contractors are not registered as securities broker-dealers or investment advisors with the U.S. SEC, any state authority, or any self-regulatory organization.

Trademarks

All trademarks referenced are the property of their respective holders, and no endorsement is implied.

Liability Disclaimer

Publisher makes no guarantee or warranty regarding the information provided. To the maximum extent permitted by law, Publisher disclaims liability for any losses arising from reliance on this communication.Investors are encouraged to review the disclaimers and disclosures provided by Great Pacific Gold Corp., available here, as they contain important information relevant to investment decisions.